B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hour Place Clock Repair paid $1,800 cash in advance for a one year insurance policy.According to the matching principle,if 4 months of the policy has expired by the balance sheet date,how much should Hour Place Clock Repair report as Prepaid Insurance?

A) $0

B) $600

C) $1,200

D) $1,800

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The ____________________ principle requires that if income is to be properly measured,all expired costs associated with the earning of revenue must be deducted from the revenue in the same accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the statement below that is incorrect.

A) Information about profits appears in the income statement.

B) Information about assets,liabilities and owner's equity is provided primarily in the balance sheet.

C) Information about how cash is used as well as when cash is received can be found on a business's balance sheet.

D) Meaningful information about the financial condition of a business can be determined by analyzing a business's financial statements.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is allowed under generally accepted accounting principles?

A) A company was offered $60,000 for land that it had purchased for $15,000.The company did not sell the land but increased the Land account to $60,000.

B) An owner lists the full cost of his or her personal automobile,which is occasionally used for business purposes,on the company's balance sheet.

C) A large company recorded the $20 cost of a tool as an expense,although the item is expected to be used for 3 years.

D) The Equipment account shows a balance of $55,000.This amount represents the original cost of $75,000 less the accumulated depreciation of $20,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The separate economic entity assumption assumes that:

A) financial events are meaningful only when they can be expressed in economic terms.

B) the business will continue to operate indefinitely.

C) the financial statements of a business reflect the affairs of the business-not the affairs of the owners.

D) a business's life can be separated into time periods with income being reported within one economic time period.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An accountant who records revenue when a credit sale is made rather than waiting for the receipt of cash from the customer is

A) following the accrual principle.

B) following the conservatism constraint.

C) violating generally accepted accounting principles.

D) following the consistency principle.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hour Place Clock Repair paid $2,400 cash in advance for a six month advertising contract with the local newspaper.According to the matching principle,if 2 months of the contract has expired by the end of the current fiscal year,how much should Hour Place Clock Repair report as Advertising Expense on the Income Statement?

A) $0

B) $400

C) $800

D) $2,400

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

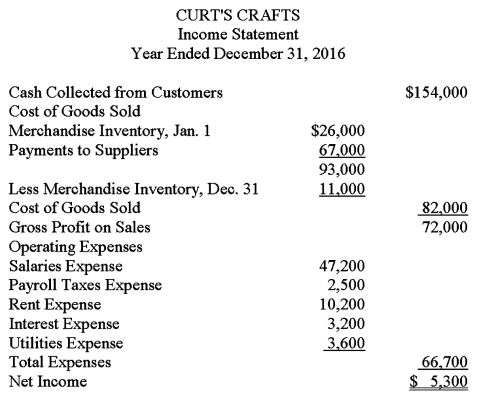

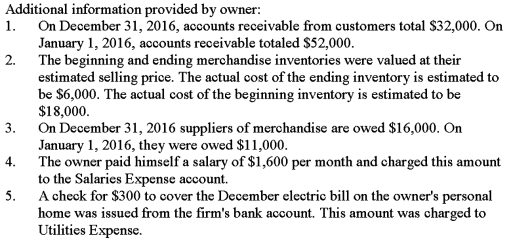

The income statement shown below was prepared and sent by Curtis Brown,the owner of Curt's Crafts,to several of his creditors.The business is a sole proprietorship that sells crafts and toys.An accountant for one of the creditors looked over the income statement and found that it did not conform to generally accepted accounting principles.Using the following additional information provided by the owner,prepare an income statement in accordance with generally accepted accounting principles.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Tamar Snyder opened a shoe store,her accountant did not include the cash in her personal savings account as one of the assets of the business.This is an example of

A) the separate entity assumption.

B) the conservatism constraint.

C) the materiality constraint.

D) industry practice constraint.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The monetary unit assumption assumes that:

A) the business will continue to operate indefinitely.

B) revenues and expenses of a business can be separated into separate time periods.

C) the idea that expressing financial facts and events is meaningful only when they can be expressed in monetary terms.

D) the value of money is not stable.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Assets are carried on the books at historical cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The basic financial reports of a business DO NOT provide users information about

A) profits.

B) economic resources (assets) .

C) claims against the assets (liabilities and owner's equity) .

D) competitors of a business.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) The Securities and Exchange Commission (SEC) issues the Statements of Financial Accounting Standards.

B) Statements issued by the Financial Accounting Standards Board (FASB) are binding on the members of the American Institute of Certified Public Accountants (AICPA) .

C) An act of law gave the SEC the authority to determine the form and content of accounting reports filed by companies under its jurisdiction.

D) The Financial Accounting Standards Board is an independent organization.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Statements of Financial Accounting Standards that automatically become generally accepted accounting principles are issued by

A) the IRS.

B) the SEC.

C) the FASB.

D) the AICPA.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The matching principle is being applied when the cost of equipment is depreciated over its useful life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Under the accrual basis of accounting,revenue is recorded in the period in which it is earned.

B) Under the accrual basis of accounting,expenses are recorded in the period in which they are paid.

C) Under the accrual basis of accounting,revenue is recorded in the period in which it is received.

D) Under the accrual basis of accounting,revenue is recorded in the period in which it is paid.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Financial Accounting Standards Board is

A) a branch of the AICPA.

B) a branch of the IRS.

C) an independent organization.

D) a branch of the SEC.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because financial statements must be objective and based on verifiable evidence,data obtained from estimates cannot be presented.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The SEC's 2003 report to the Congress on "principles-based" accounting observed that the first characteristic of objectives-based standards,as dictated by the Sarbanes-Oxley Act,is that any standard must be based on

A) the cost-benefit test.

B) an improved and consistently applied framework.

C) qualitative characteristics.

D) transparency.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 67

Related Exams