A) $25,000 ordinary and $50,000 unrecaptured §1250 gain.

B) $25,000 §1231 gain and $50,000 unrecaptured §1250 gain.

C) $75,000 ordinary gain.

D) $75,000 capital gain.

E) None of thesE.Unrecaptured §1250 recaptures the lesser of depreciation taken ($50,000) or gain ($75,000) .This amount is then taxed at no more than 25%.The remaining $25,000 gain would be §1231 gain.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The gain or loss realized is always recognized for tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ashburn reported a $105,000 net §1231 gain in year 6.Assuming Ashburn reported $60,000 of nonrecaptured §1231 losses during years 1-5,what amount of Ashburn's net §1231 gain for year 6,if any,is treated as ordinary income?

A) $0.

B) $45,000.

C) $60,000.

D) $105,000.

E) None of thesE.The 1231 lookback rule recharacterizes $60,000 of the §1231 gain to ordinary income,the amount of the prior 5 year losses that received ordinary loss treatment.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The amount realized is the sale proceeds less the adjusted basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Butte sold a machine to a machine dealer for $50,000.Butte bought the machine for $55,000 several years ago and has claimed $12,500 of depreciation expense on the machine.What is the amount and character of Butte's gain or loss?

A) $7,500 §1231 loss.

B) $5,000 §1231 loss.

C) $7,500 ordinary gain.

D) $7,500 capital gain.

E) None of thesE.§1245 recaptures the lesser of depreciation taken ($12,500) or gain ($7,500) as ordinary income.Any remaining gain would be §1231 gain.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the primary purpose of a third-party intermediary in a deferred like-kind exchange?

A) To facilitate finding replacement property.

B) To help acquire the replacement property.

C) To prevent the seller from receiving cash (boot) that will taint the transaction.

D) To certify the taxpayer's Form 8824.

E) All of thesE.The receipt of cash in a transaction qualifies as boot and requires the recognition of gain.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pelosi Corporation sold a parcel of land valued at $300,000.Its basis in the land was $250,000.For the land,Pelosi received $150,000 in cash in the current year and a note providing Pelosi with $150,000 in the subsequent year.What is Pelosi's recognized gain in the current and subsequent year,respectively?

A) $0,$50,000.

B) $10,000,$40,000.

C) $25,000,$25,000.

D) $50,000,$0.

E) None of thesE.The gain recognized in each year is calculated as follows;the gross profit percentage is multiplied by the amount realized in each year to determine the recognized gain.The gross profit percentage is the gain realized over the total amount realized.The $50,000 gain realized is the $300,000 amount realized ($150,000 cash plus $150,000 note) less the $250,000 adjusted basis.In the current year,the $150,000 proceeds (cash) is multiplied by the 16.67 percent gross profit percentage to determine the $25,000 gain recognized.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an involuntary conversion?

A) Destruction caused by a hurricane.

B) Imminent domain.

C) A foreclosure.

D) Fire damage.

E) All of these are involuntary conversions.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All tax gains and losses are ultimately characterized as either ordinary or capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For corporations,§291 recaptures 20 percent of the lesser of depreciation taken or the realized gain as ordinary income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

After application of the lookback rule,net §1231 gains become capital while net §1231 losses become ordinary.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

§1250 recaptures the excess of accelerated depreciation over straight line depreciation on real property placed in service between 1981 and 1986 as ordinary income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following realized gains results in a recognized gain?

A) Farm machinery traded for farm machinery.

B) Sale to a related party.

C) Involuntary conversion.

D) Iowa cropland exchanged for a Minnesota warehouse.Realized gains,but not losses,on sales to a related party are recognized.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions results solely in §1245 gain?

A) Sale of machinery held for less than one year.

B) Sale of machinery held for more than one year and where the gain realized exceeds the accumulated deprecation.

C) Sale of machinery held for more than one year and where the accumulated deprecation exceeds the gain realized.

D) Sale of land held for more than one year and where the amount realized exceeds the adjusted basis.

E) None of thesE.§1245 gain is the lesser of gain realized or accumulated depreciation.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Taxpayers can recognize a taxable gain even though an asset's real economic value has declined.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why does §1250 recapture no longer apply?

A) Congress repealed the code section.

B) The Tax Reform Act of 1986 changed the depreciation of real property to the straight-line method.

C) §1245 recapture trumps §1250 recapture.

D) Because unrecaptured §1250 gains now apply to all taxpayers instead.

E) None of thesE.§1250 only recaptures excess depreciation,the excess of accelerated over straight-line depreciation.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Foreaker LLC sold a piece of land that it uses in its business for $52,000.Foreaker bought the land two years ago for $42,500.What is the amount and character of Foreaker's gain?

A) $9,500 §1221.

B) $9,500 §1231.

C) $9,500 §1245.

D) $9,500 §1250.

E) None of thesE.Land used in a trade or business is a §1231 asset.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

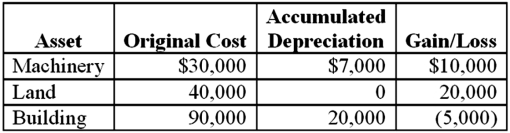

Brandon,an individual,began business four years ago and has sold §1231 assets with $5,000 of losses within the last 5 years.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 35 percent,what effect do the gains and losses have on Brandon's tax liability?

A) $25,000 ordinary income,$8,750 tax liability.

B) $25,000 §1231 gain and $3,750 tax liability.

C) $13,000 §1231 gain,$12,000 ordinary income,and $6,150 tax liability.

D) $12,000 §1231 gain,$13,000 ordinary income,and $6,350 tax liability.

E) None of thesE.Depreciation recapture of $7,000 becomes ordinary income.In addition,Brandon has a $23,000 §1231 gain and $5,000 §1231 loss,which nets to an $18,000 net §1231 gain.The 1231 lookback rule recharacterizes $5,000 of the §1231 gain to ordinary income.Thus,$12,000 (35%) of ordinary income and $13,000 (15%) of §1231 gain.The calculations results in $6,150 of tax.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Boot is not like-kind property involved in a like-kind exchange.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When does unrecaptured §1250 gains apply?

A) When the taxpayer makes the election.

B) It applies only when non-corporate taxpayers sell depreciable real property at a gain.

C) It applies when §1245 recapture trumps §1250 recapture.

D) It applies only when real property purchased before 1986 is sold at a gain.

E) None of thesE.Unrecaptured §1250 gain only applies to the lesser of realized gain or accumulated depreciation on sales of real property by non-corporate taxpayers.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 88

Related Exams